A battery start-up that’s backed by iPod inventor and Nest founder Tony Fadell, and which claims to have found a green and scalable way to make lithium-ion batteries more efficient, on Tuesday announced that it raised $18.5 million in its Series A funding round.

New Orleans-based Advano is focused on increasing batteries’ energy density by replacing the graphite in the anode — the battery’s negative side — with silicon, which is able to hold roughly ten times more lithium than graphite.

Ever since Sony first commercialized the lithium-ion battery in 1991, scientists have been toiling over how to make these devices cheaper, safer and more efficient, and Advano is far from the first company to explore using silicon instead of graphite. Other companies developing these types of batteries include Sila Nanotechnologies, for example, which is valued at over $1 billion.

Advano co-founder and CEO Alexander Girau said that what makes his company different is its use of recycled silicon, which cuts production costs while reducing the environmental impact, as well as the start-up’s laser focus on developing solutions that are scalable.

“We’re not trying to make the best battery in the world and figuring out how to make trillions of them. We’re trying to economically improve the trillions of batteries that will exist,” Girau said to CNBC.

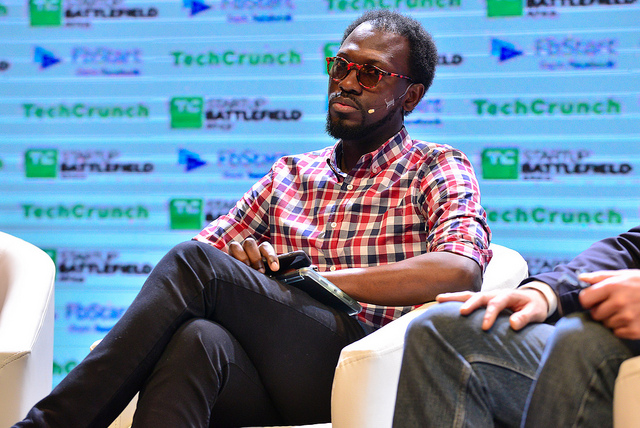

San Francisco and Lagos-based fintech startup Flutterwave has raised a $35 million Series B round and announced a partnership with Worldpay FIS for payments in Africa.

With the funding, Flutterwave will invest in technology and business development to grow market share in existing operating countries, CEO Olugbenga Agboola — aka GB — told TechCrunch.

The company will also expand capabilities to offer more services around its payment products.

More than payments

“We don’t just want to be a payment technology company, we have sector expertise around education, travel, gaming, e-commerce, fintech companies. They all use our expertise,” said GB.

That means Flutterwave will provide more solutions around the broader needs of its clients.

The Nigerian-founded startup’s main business is providing B2B payments services for companies operating in Africa to pay other companies on the continent and abroad.

Launched in 2016, Flutterwave allows clients to tap its APIs and work with Flutterwave developers to customize payments applications. Existing customers include Uber, Booking.com and e-commerce company Jumia.

In 2019, Flutterwave processed 107 million transactions worth $5.4 billion, according to company data.

Flutterwave did the payment integration for U.S. pop-star Cardi B’s 2019 performances in Nigeria and Ghana. Those are two of the countries in which the startup operates, in addition to South Africa, Uganda, Kenya, Tanzania, Zambia, the U.K. and Rwanda.

It’s clear that work authorization for international talent in the United States is getting increasingly harder in the Trump administration. Tech startups are facing hiring challenges, and the entrepreneurs within them are left in flux as documentation and fees are added atop meetings and work responsibilities.

Subscribe to the Crunchbase Daily

To make the immigration process less opaque for entrepreneurs, Seattle-based startup Legalpad has raised a $10 million Series A led by Amplo. Other investors such as Global Founders Capital, 8VC, Liquid 2 Ventures, Tekton Ventures, Gaingels and Collate Capital filled the round.

The startup, founded by Sara Itucas and Todd Heine, uses a mix of software and attorney aid to navigate the visa process for startup employees. Hailing from Techstars, Legalpad works with other early-stage startup accelerators to help talent stay in the country after they graduate from programs.

Legalpad may be pricier than a traditional law firm, but it is faster, said Itucas, the company’s co-founder and an immigrant herself. Traditional law firms can take between four and six months to put together a competitive application for a visa, she said. Legalpad claims to take two months.

Synopsys Acquires Tinfoil for Application Security Testing

Synopsys acquires Tinfoil, which offers dynamic application security testing (DAST) & Application Program Interface (API) security testing solutions.

Synopsys has acquired Tinfoil Security, which offers dynamic application security testing (DAST) and Application Program Interface (API) security testing solutions. Financial terms were not disclosed.

This is M&A Deal Number 36 that ChannelE2E has covered in 2020. See the complete M&A deal list here.

Neither Synopsys nor Tinfoil specifically promote their offerings to channel partners. (Synopsys highlights a targeted partner effort here.) But VARs and MSPs can recommend the software to customers that need to strengthen secure application development and related DevOps tasks. Moreover, IT security professionals across the IT channel leverage Synopsys and Tinfoil to harden their application code.

Synopsys Acquires Tinfoil: Potential Synergies

Tinfoil Security was founded in 2011 by Ainsley Braun (pictured above) and Michael Borohovski, two MIT and intelligence community alumni.

Tinfoil Security’s software identifies vulnerabilities on web applications and integrates with DevOps workflows, the company asserts. Moreover, the Tinfoil Security API Scanner detects vulnerabilities in APIs, including web-connected devices such as mobile backend servers, IoT devices, as well as any RESTful APIs, the seller adds.

The acquisition appears to align well with Synopsys’s core focus. The company’s software helps development teams build secure software. Customers can quickly find and fix vulnerabilities and defects in proprietary code, open source components, and application behavior, Synopsys claims.

Viva Republica, the Korean financial technology company that operates mobile financial services Toss, announced that it has secured preliminary approval for a license to operate its digital bank in the country.

The firm said the Financial Services Commission of Korea has given its preliminary approval for Toss Bank, a challenger bank for the ‘underbanked’. This means Toss Bank could soon become the third digital bank in Korea with a license to operate banking services even without a physical branch network.

However, Toss Bank is expected to begin operation only in the first half of 2021 if it gains the final approval of the license, Viva Republica said. It will be competing with Kakao Bank and K Bank, the first two digital banks approved by authorities to operate in 2017.

“As a challenger bank for the ‘underbanked’, Toss Bank will build a frictionless and fair way to manage money, fulfilling the needs of individuals and small business customers, including those with thin files and mid-range credit scores,” Viva Republica said in a statement.

As a digital bank, Toss Bank will offer various banking products and services, such as current accounts, credit and loan products, and several other financial services to individuals and businesses in Korea, one of the world’s fastest-growing digital banking markets.

Viva Republica CEO SG Lee said the digital bank license will allow Toss to broaden its product offering and further accelerate the group’s mission to innovate the financial industry.

Toss has already become a leading financial super app in Korea, with Viva Republica valued at $2.2 billion in a recent funding round. Toss posted $48 billion of run-rate transaction volume annually.

Toss was launched as a P2P money transfer service in 2015. Today, Toss now delivers a full suite of financial services including banking services, financial dashboard, credit score management, and investment products.

Logistics-technology startup Freightwalla has raised $4 million (approximately Rs 28.30 crore at current exchange rates) in its Series A funding round from a clutch of investors.

Venture capital firms such as the US-based Amplo, FJ Labs and Rogue One Capital participated in the funding round. Existing investors such as Kae Capital and Tekton Ventures also contributed to the round, Freightwalla said in a statement.

Sanjay Bhatia, co-founder and chief executive officer at Freightwalla, said the latest funds will be used for geographical expansion and enhance the technological infrastructure. “Since the last round of funding we have witnessed a nine-time growth in our volumes, eight-time growth in revenue and a five-time growth in our team size,” he said.

Company co-founder and chief executive officer Sanjay Bhatia said the Series A funds will be used to expand Freightwalla’s geographical reach as well as upgrade its technological infrastructure. “Since the last round of funding we have witnessed a nine-time growth in our volumes, eight-time growth in revenue and a five-time growth in our team size,” Bhatia said.

Separately, Sheel Tyle, founder and CEO at Amplo, said the firm was confident in its investment in Freightwalla because of its being well-positioned to bring “price visibility and shipping accuracy” to importers and exporters of Indian cargo.

May Mobility, a Michigan-based startup that is operating autonomous shuttle services in three U.S. cities, has raised $50 million in a Series B round led by Toyota Motor Corp.

The funding, which comes less than a year after May Mobility raised $22 million, will be used to expand every aspect of the company, including its AV shuttle fleet, as well as its engineering and operations staff.

May Mobility has 25 autonomous low-speed shuttles spread out between Detroit and Grand Rapids, Michigan and Providence, Rhode Island — the three cities in which it operates. The startup wants to build that number up to 25 vehicles per city, co-founder and COO Alisyn Malek told TechCrunch. That fleet size improves the economic picture for the startup and will begin to meaningfully impact transportation in that city.

This latest round does more than provide May Mobility with capital. The startup, which launched in 2017, has gained a customer as well. Toyota has picked May Mobility as one of its “autonomous driving providers for future open platforms,” according to the startup.

Toyota and May Mobility didn’t share specifics about what this partnership will lead to. But it will likely pair the startup’s autonomous vehicle technology with the Toyota e-Palette, a platform the automaker unveiled in 2018 at CES, the annual tech trade show in Las Vegas.

“The shape of Coupang, the business model of Coupang … went through a lot of change” — Bom Kim, FOUNDER AND CEO OF COUPANG

SEOUL — For many would-be entrepreneurs, Harvard’s prestigious MBA program provides an important step in the journey from dreamer to founder.

But for Bom Kim, that step was quicker than most. Just six months into the program, he dropped out, determined to make it on his own. Now, less than a decade on, Kim is the billionaire brains behind South Korea’s most valuable start-up.

“I had a belief when I was in grad school that I had a very short window to really make something that had an impact,” he told CNBC Make It.

Kim is founder and CEO of Coupang, the $9 billion e-commerce giant that’s been dubbed the Amazon of South Korea.

He started the business in Seoul in 2010 to take advantage of what he saw as the growing technology opportunity. Today his company boasts a user-base almost half the size of the country’s population.

However, as the 41-year-old founder recently told CNBC Make It, he didn’t exactly set out to become the next Jeff Bezos.

Cuvva, the app-based insurance provider that began life offering pay-as-you-go driving cover but has since expanded to also sell travel insurance, has raised £15 million in Series A funding.

Backing comes from RTP Global, Breega and Digital Horizon, joining existing investors LocalGlobe, Techstars Ventures, Tekton and Seedcamp. A number of angels also joined the round, including Dominic Burke, the CEO of Jardine Lloyd Thompson, and Faisal Galaria, the former chief strategy and investments officer of GoCompare.

Launched in 2016 when founder Freddy Macnamara (pictured) become frustrated he couldn’t let others drive his car intermittently because of lack of insurance cover, Cuvva was an early pioneer of pay-as-you-go car insurance.

The idea, which was easier explained than done, was to make it possible to insure a car only when it was being driven, and therefore be cheaper for low-mileage drivers, and, via an app and access to the DVLA database, make it easier to on-board new drivers for pay-as-you-drive cover.

The insurtech still offers hourly car insurance, but its product line has since been expanded to daily covery, as well as a product specifically aimed at learner drivers. In addition, Cuvva entered the travel insurance space, no doubt spotting overlap with its presumably younger, millennial demographic.

Read More>>>https://techcrunch.com/2019/12/03/cuvva-raises-15m/

Singapore-based dental startup Zenyum has raised US$13.6 million in series A funding from RTP Global, Sequoia India, TNB Aura, and Enterprise Singapore’s Seeds Capital, among other investors.

Zenyum plans to use the fresh funds to fuel its expansion plans to markets like Vietnam, Indonesia, and Taiwan. It currently operates in Singapore, Hong Kong, Malaysia, and Thailand.

Founded in 2018, Zenyum aims to make invisible dental braces more accessible in Asia. Through its technology, it provides 3D-printed braces and offers cosmetic dental treatment. Its app serves as a touchpoint between doctors, Zenyum’s in-house orthodontists, and customers, saving chair time in clinics.

Frontier Car Group, the Berlin-based startup building used car marketplaces targeting high-growth, emerging markets, has picked up another significant round of funding from a strategic backer also focusing on the same geographical opportunity.

Today, OLX, the online classifieds division Prosus (the digital division of Naspers that listed earlier this year in Europe) announced that it would invest up to $400 million in Frontier, in a mix of equity, secondary share acquisitions and existing business shares. The deal will include a primary capital injection of an unspecified amount, which OLX has confirmed to me values Frontier Car Group at $700 million, post-money.

In terms of business shares: OLX also said that it will be contributing its shares in a JV it had in place with Frontier in India and Poland. Meanwhile, the secondary acquisitions — the shares are currently held by other investors, founders and management — are subject to a tender process. The markets that Frontier operates in now include Nigeria, Mexico, Chile, Pakistan, Indonesia and the USA (where it acquired WeBuyAnyCar last year), in addition to India and Poland.

Notably, even before the full $400 million amount is exercised (that is, after the tender process is completed), an OLX spokesperson confirmed that first capital injection will make it Frontier’s largest single shareholder (but not the majority shareholder), which essentially values the deal at less than $350 million (based on the $700 million valuation).

NEW YORK, Oct. 30, 2019 /PRNewswire/ — Capital, a New York-based provider of non-dilutive growth capital to fast-growing companies, today announced the launch of its online platform. Built to make the fundraising process more efficient, Capital gives entrepreneurs the ability to see their financing options and acquire funding in as little as one step. Starting today, Capital will fund over $100 million into companies through its automated investing solution called The Capital Machine, which underwrites a company’s financial data and delivers financing offers for $5 million to $50 million in less than 24 hours.

Technology companies have long been considered high-risk investments, limiting the options and control entrepreneurs have during the fundraising process. After seeing how much founders were giving up when raising venture dollars, Capital designed a place where companies can go to see the viable financing options for their business and acquire the most efficient funding to grow without giving up equity ownership. Capital’s first product, a modern venture debt alternative, replaces legacy offerings with larger checks, no warrants and no dilution for founders producing 2-9x more wealth for them at exit.

Fintech startup Bnext has raised a $25 million funding round. The Spanish company is building a banking product and has managed to attract 300,000 active users.

DN Capital, Redalpine and Speedinvest are leading today’s funding round. Existing investors Founders Future and Cometa are also participating. Other investors include Enern, USM and Conexo.

When you open a Bnext account, you get a card and you can upload money to your account. Bnext accounts aren’t technically bank accounts — the company has an e-money license. You can then use your card and spend money anywhere around the world without any foreign transaction fee. You also can freeze and unfreeze your card from the app.

“As of now we’ll stick to the e-money license, as our international expansion plans complicate potential passporting of banking licenses. We will first need to understand in which countries makes more sense to get a banking license, and then we’ll make a decision,” co-founder and CEO Guillermo Vicandi told me.

You also can connect to your traditional bank accounts from the Bnext app. This way, you can manage your money from a single app.

And Bnext takes this one step further by offering financial products from third-party companies as well. It’s clear that the company wants to build a financial hub, the only finance app that you need.

You can lend money to small and medium businesses and earn interest through October, you can save money using Raisin, you can get a loan, a mortgage, an insurance product, etc. Bnext generates revenue from those partnerships.

While Bnext only operates in Spain for now, the company has managed to attract 300,000 active users. It processes €100 million in transactions every month ($109 million).

As a dentist, Seunggun Lee was used to filling holes in people’s teeth. But when he spotted a gap in South Korea’s banking industry, it was too blatant to ignore.

It didn’t matter to him that the idea was illegal at that time.

“I thought this service should exist in Korean society — regardless of whether it was legal or not,” Lee told CNBC Make It.

The young entrepreneur was hardly risk-averse, after all. Something about quitting his steady job as a dentist and pumping $400,000 (a 50/50 combination of his own savings and bank loans) into a “bunch of crazy ideas” gave him a certain brazenness.

A money maker

Lee is the founder and CEO of Toss, a South Korean money transfer app which last year became the country’s first $1 billion financial technology start-up.

He started the business in 2014, when similar peer-to-peer (P2P) money transfer apps — such as PayPal’s Venmo — were taking off internationally. But the red tape in South Korea’s famously regulated banking system made such services effectively illegal.

“I was able to see a lot of products that existed in the U.S. and I thought: If this was available in Korea, then it’s going to be huge,” said Lee, now 37, who described the country’s transfer system as a “cumbersome” multi-step process at the time. But getting it off the ground took some convincing — not just of regulators and investors, but his parents too.

Hong Kong-based Aspex Management leads investment in P2P money transfer service

Hong Kong-based equity investor Aspex Management led a $64 million funding round for South Korean fintech startup Viva Republica, the PayPal-backed creator of financial services platform Toss.

Viva Republica said the fresh funds boosted the company’s value to $2.2 billion, with participation from Toss’ existing investors, including Kleiner Perkins, Altos Ventures, Singapore’s GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.

The Seoul-based fintech last raised $80 million in a funding round in December, co-led by Korean investors, Kleiner Perkins and Ribbit Capital and backed by many return investors. So far, Viva Republica has raised about $250 million.

Founded in 2013, Viva Republic launched Toss four years ago as a simple and frictionless P2P money transfer service. Toss has evolved into a platform providing a range of financial services in one app, including banking, money transfer, dashboard and credit score management.

To date, Toss has been downloaded more than 30 million times and has over 13 million registered users, over a fifth of South Korea’s population, with more than $42 billion of transactions processed.

“We are truly pleased that Toss has gained further momentum to embark upon the next phase of its journey,” said SG Lee, CEO of Viva Republica.

The lead investor in this round, Aspex Management, is an equity investment firm focused on Asia founded in 2018. It looks to invest in industries and companies exposed to large addressable markets with long-term potential and those undergoing structural changes.

“We like the large addressable market financial services offer and the unique leading position Toss occupies among mobile consumers,” said Hermes Li, founder and chief investment officer of Aspex Management.

Before launching Aspex Management, Li was an executive managing director for Och-Ziff Management, one of the largest alternative asset managers in the world.

Read More>>>

Hong Kong-based equity investor Aspex Management led a $64 million funding round for South Korean fintech startup Viva Republica, the PayPal-backed creator of financial services platform Toss.

Viva Republica said the fresh funds boosted the company’s value to $2.2 billion, with participation from Toss’ existing investors, including Kleiner Perkins, Altos Ventures, Singapore’s GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.

The Seoul-based fintech last raised $80 million in a funding round in December, co-led by Korean investors, Kleiner Perkins and Ribbit Capital and backed by many return investors. So far, Viva Republica has raised about $250 million.

Founded in 2013, Viva Republic launched Toss four years ago as a simple and frictionless P2P money transfer service. Toss has evolved into a platform providing a range of financial services in one app, including banking, money transfer, dashboard and credit score management.

To date, Toss has been downloaded more than 30 million times and has over 13 million registered users, over a fifth of South Korea’s population, with more than $42 billion of transactions processed.

“We are truly pleased that Toss has gained further momentum to embark upon the next phase of its journey,” said SG Lee, CEO of Viva Republica.

The lead investor in this round, Aspex Management, is an equity investment firm focused on Asia founded in 2018. It looks to invest in industries and companies exposed to large addressable markets with long-term potential and those undergoing structural changes.

“We like the large addressable market financial services offer and the unique leading position Toss occupies among mobile consumers,” said Hermes Li, founder and chief investment officer of Aspex Management.

Before launching Aspex Management, Li was an executive managing director for Och-Ziff Management, one of the largest alternative asset managers in the world.

Tripalink, a Los Angeles-based real estate startup providing co-living space for students and young professionals, has raised a $10 million Series B at a $100 million valuation.

Founded by University of Southern California-Los Angeles (USC) graduates in 2016, Tripalink has grown rapidly. According to CEO Donghao Li, the company has been profitable since the year it was founded and tripled its revenue in 2018.

The latest financing marks Tripalink’s third funding round in a ten-month period, Li said, bringing its total capital raised to $20 million. Existing investors Calin SJG Fund, China-based K2VC, and Tekton Ventures participated in the round, along with new investor Oriza Ventures.

Tripalink has two product lines. First, it works with small and medium-sized developers to create and manage co-living spaces. Second, it has also become a developer, building out its own co-living projects.

Tripalink helps provide furnished, all utilities-paid co-living spaces in Los Angeles, Seattle, Pittsburgh, Irvine, Austin, and Philadelphia. It claims that its properties are “fully occupied” in most of the cities where it currently operates. The new capital will mostly go toward market expansion with a goal of being in 30 cities by 2020, according to Li. By the end of this year, the company expects it will have developed itself nearly 4,000 beds via master leases or joint ventures.

“Besides building a community, our price per bedroom is much cheaper compared to most luxury apartments,” Li told Crunchbase News. “Purchasing land and then building our own co-living space is our ultimate goal in each market.”

The model is attractive to developer partners because the more bedrooms in a unit, the higher the value of their property, Li said. Tripalink purposely targets centrally located areas that are more likely to see appreciation over time.

Read more>>>

San Francisco and Lagos-based fintech startup Flutterwave has partnered with Chinese e-commerce company Alibaba’s Alipay to offer digital payments between Africa and China.

Flutterwave is a Nigerian-founded B2B payments service (primarily) for companies in Africa to pay other companies on the continent and abroad.

Alipay is Alibaba’s digital wallet and payments platform. In 2013, Alipay surpassed PayPal in payments volume and currently claims a global network of more than 1 billion active users, per Alibaba’s latest earnings report.

A large portion of Alipay’s network is in China, which makes the Flutterwave integration significant to capturing payments activity around the estimated $200 billion in China-Africa trade.

“This means that all our merchants can accept or install Alipay as a payment type to accept payments from its billion users,” Flutterwave CEO Olugbenga Agboola — aka GB — told TechCrunch.

“There’s a lot of trade between Africa and China and this integration makes it easier for African merchants to accept Chinese customer payments.”

A Flutterwave company release added, “We’ve managed to connect African countries…to each other so it was about time we connected Africa to the world. We started with the U.S. … but you can’t connect Africa to the world without China.”

An Alipay spokesperson confirmed with TechCrunch the Flutterwave collaboration. Flutterwave will earn revenue from the partnership by charging its standard 3.8% on international transactions. The company currently has more than 60,000 merchants on its platform, according to Agboola.

The Flutterwave-Alipay alliance developed out of Agboola’s acceptance in Alibaba’s Africa eFounders Fellowship.

“Because of that I was in China to do meetings with Jack Ma and the only ask I had from that trip is ‘I want to be the Africa payment infrastructure that plugs directly into Alipay,’ ” Agboola said.

The Alipay partnership follows one between Flutterwave and Visa earlier this year to launch a consumer payment product for Africa, called GetBarter.

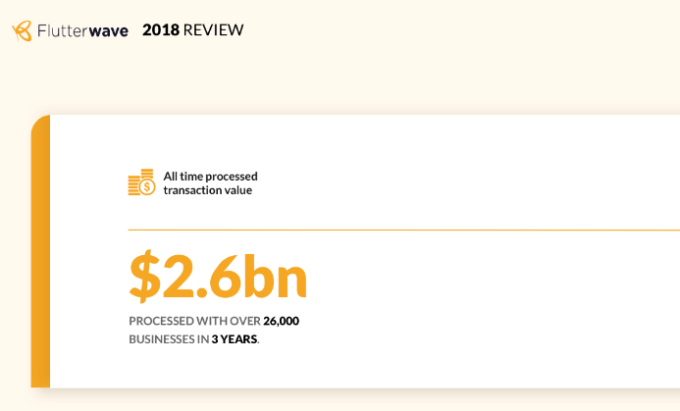

Founded in 2016, Flutterwave allows clients to tap its APIs and work with Flutterwave developers to customize payments applications. Existing customers include Uber, Booking.com and e-commerce unicorn Jumia.com. Flutterwave has processed 100 million transactions worth $2.6 billion since inception, according to company data.

Read More>>>

Seattle startup Deako raised $3.5 million to kick production of its “plug and play” smart light switches into high gear.

Founded in 2015, Deako sells a modular light switch that can function with either conventional or smart lights, allowing a homeowner to easily swap in high-tech, remotely controlled lighting. Its technology works off a home’s existing wiring and Deako says it lets homebuilders market their projects as smart homes, without a lot of upfront cost.

Deako is piloting its technology with more than a dozen national homebuilders, and the startup has targeted Dallas, Austin, Denver, Phoenix, Orlando and Atlanta as its main markets. Deako’s homebuilder partners construct more than 100,000 homes per year.

“The last 12 months have seen a dramatic shift from builders experimenting with smart technology in their homes to it being a mandated standard in every home built by most of the top national builders.” Deako COO Wes Nicol said in a statement. “This has been driven by changing demographics of homebuyers as well as reduced cost and standardization of major smart home voice control platforms such as Amazon Alexa and Google Home.”

The new funding, which brings the company’s lifetime total to $20 million, will enable Deako to up production capacity to meet demand from its homebuilder partners. The company will also deploy the cash infusion to expand sales and marketing efforts and accelerate new product development.

Seattle-based Columbia Pacific Advisors funded the entire round. It has a fund that addresses “financing needs of business borrowers that are not met by traditional lenders or equity capital sources,” according to a Deako press release. The startup chose Columbia Pacific because it was willing to provide funds without significantly diluting Deako shareholder value.

Today Deako has 20 employees, and it plans to hire five to eight more people in the coming months. CEO Derek Richardson was an early employee at BlackBerry and spent 12 years at Cypress Semiconductor. The inspiration to start Deako came from Richardson’s three daughters.

“They’re running around the house turning on lights,” Richardson told GeekWire last year. Before smart lights, that meant roaming room to room each evening, flipping switches. That has changed.

“Every night I hit one button,” he said, “and instantly all the lights are turned off.”

The larger smart home market is growing at a rapid clip as homeowners’ appetite for tech increases. The global market for smart home devices is expected to grow nearly 27 percent in 2019 to 832.7 million shipments, according to an International Data Corp. report in March.

There’s a flood of competitors selling smart light products — Lutron Caseta, Leviton Decora Smart, Wemo, GE Z-Wave, Legrand Adorne by Legrand. Even still, Deako — a Y-Combinator Alumni and GeekWire Summit “Invention We Love” — claims to offer a suite of features that the competition doesn’t match.

Read More>>

Nowports, a developer of software and services to track freight shipments from ports to destinations across Latin America, has aims to become the regional answer to Flexport’s billion-dollar digital shipping business.

Almost 54 million containers are imported and exported from Latin America each year, and nearly half of them are either delayed or lost due to mismanagement.

Nowports is pitching shippers on its digital management software to keep track of each container, and has signed on a number of leading venture capital firms to fulfill its mission.

The Monterrey, Mexico-based company raised $5.3 million in its seed round of financing. The round was led by Base10 and Monashees, with participation from Y Combinator and additional investors like Broadhaven, Soma Capital, Partech, Tekton and Paul Buchheit.

“In Nowports we saw a very strong combination: well prepared and ambitious team using technology to help thousands of customers to improve their importing and exporting processes. By adding efficiency, reliability, and transparency to change a multi-billion dollar industry, Nowports has been able to attract many clients that saw significant improvements in their daily routines by using the solution” said Caio Bolognesi, general partner from Monashees, in a statement.

Read More>>>